[ad_1]

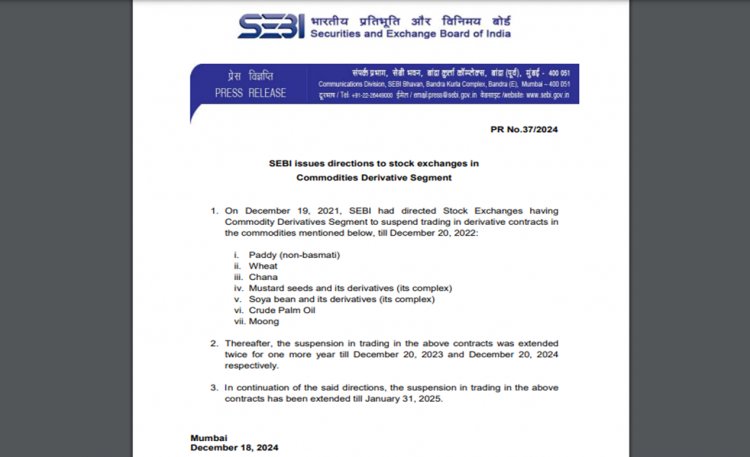

In a notification issued on Wednesday, SEBI said the suspension of trading in futures contracts would now continue until January 31, 2025, for paddy (non-basmati), wheat, chana, mustard seeds and its derivatives, soya bean and its derivatives, crude palm oil and moong.

Market regulator SEBI has extended the suspension of derivative trading in seven agricultural commodities until January 31, 2025. The ban was imposed for one year on December 19, 2021, and has been extended third time since then—first until December 20, 2023, and later until December 20, 2024.

This time, the ban has been extended for just one month, which is being seen as an indication that futures trading in suspended agricultural commodities may be permitted early next year. The National Commodity and Derivatives Exchange (NCDEX) has consistently demanded the removal of the ban.

In a notification issued on Wednesday, SEBI said the suspension of trading in the derivative contracts has been extended til January 31, 2025, for paddy (non-basmati), wheat, chana, mustard seeds & its derivatives, soya bean & its derivatives, crude palm oil and moong.

The reasons behind the ban on futures trading in these agricultural commodities are said to curb food inflation and speculation in the commodity market. However, even without derivative trading, the prices of food items have remained high, and controlling food inflation remains a challenge for the government. Despite record production, the price of wheat reached ₹3200 per quintal. Consumers are also paying more for pulses and edible oils.

The Indian vegetable oil industry is also demanding the lifting of the ban on futures trading to help importers hedge their risks and provide an indication of future price movements. NCDEX, which generates the majority of its volume from trading agricultural commodities, was the most affected by the ban.

Some studies have revealed that the retail price of agricultural produce did not ease after the suspension of their futures trading. On the contrary, volatility increased significantly in many commodities, which shows that retail prices are more affected by domestic and international demand-supply factors than futures trading.

It is also argued in favour of futures contracts that it can help in the price discovery of agricultural commodities and avoid market fluctuations.

[ad_2]

Source link

![NZ v AUS [W] 2024/25, New Zealand Women vs Australia Women 2nd ODI, Wellington Match Report, December 21, 2024 NZ v AUS [W] 2024/25, New Zealand Women vs Australia Women 2nd ODI, Wellington Match Report, December 21, 2024](https://i3.wp.com/img1.hscicdn.com/image/upload/f_auto/lsci/db/PICTURES/CMS/393400/393416.6.jpg?w=1200&resize=1200,0&ssl=1)