[ad_1]

Consumer companies making everything from soap to cars in India are raising alarm bells: The urban middle class The government is continuing its spending cuts for at least the second consecutive quarter as inflation and unemployment weigh on sentiment.

At least seven of India’s largest companies, including the retail arm of RIL and consumer entrepreneurs Hindustan Unileverhas flagged soft consumption demand and a challenging operating environment in its earnings for the July to September quarter.

As post-pandemic euphoria fades, high interest rates, slow wage growth and poor job prospects are hurting urban demand. While India’s rural consumers are showing signs of spending more due to a good monsoon season, which has boosted incomes in rural areas, it cannot compensate for the shortfall among about 500 million city dwellers.

fault lines in India’s consumption The story bodes ill for global giants that are counting on India’s 1.4 billion strong consumer base to boost growth amid the economic slowdown in China. Revenue from operations at the retail unit of Reliance, India’s largest retailer, declined 3.5% in the quarter ended September 30 – a decline partly attributed to weak demand for fashion and lifestyle products.

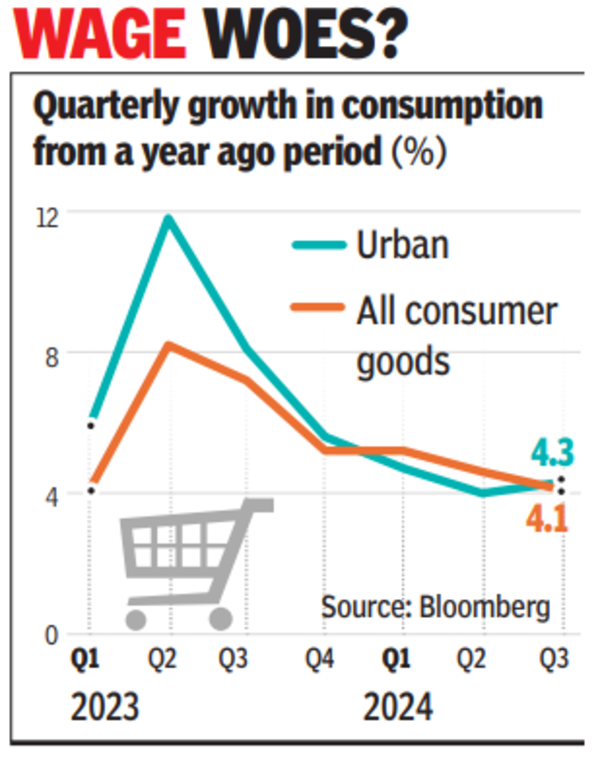

The revival of rural demand, though welcome, cannot compensate for the decline in urban aggregate expenditure. For Unilever’s India unit, small towns and villages make up only a third of its sales, CFO Ritesh Tiwari told reporters last week. Any improvement in demand growth is a few quarters away, he said. “The pattern is quite clear that urban growth has declined in recent quarters,” HUL CEO Rohit Java said after the Dove soap and Magnum ice cream maker reported weak earnings.

The slowdown is now weighing on India’s growth forecasts, although the country’s central bank has shown no signs of easing on its demand for rate cuts.

“Underlying demand conditions need to be monitored,” India’s Finance Ministry said in a report on Monday. According to the report, softening of consumer sentiments is pointing towards softening of urban consumption. The slowdown is visible across all sectors: Passenger vehicle sales fell for two consecutive months in September, while air travel has declined in three of the four months since June. India’s factory activity has been slowing since July, although it registered growth this month.

“Companies are reducing their salary outlays,” Nomura Holdings Inc. economists Sonal Verma and Aurodeep Nandi wrote in an Oct. 28 report. Companies are reducing their wage costs, reflecting a mix of weak nominal wage growth and a smaller workforce, he wrote. “We believe this weakness in urban demand is likely to persist,” Verma and Nandy wrote, pointing out that pent-up demand growth has eased following the pandemic, tight monetary policy and curbs on unsecured debt. The central bank’s tightening is hurting activity.

[ad_2]

Source link

![NZ v AUS [W] 2024/25, New Zealand Women vs Australia Women 2nd ODI, Wellington Match Report, December 21, 2024 NZ v AUS [W] 2024/25, New Zealand Women vs Australia Women 2nd ODI, Wellington Match Report, December 21, 2024](https://i3.wp.com/img1.hscicdn.com/image/upload/f_auto/lsci/db/PICTURES/CMS/393400/393416.6.jpg?w=1200&resize=1200,0&ssl=1)