[ad_1]

Bitcoin’s big stock market debut is coming at a bad time.

Three of the world’s top makers of cryptocurrency technology are planning to sell shares, giving investors a new way to bet on digital currencies. They are reportedly hoping to raise billions of dollars.

Unlike dollars or euros, which are issued by central banks, cryptocurrencies are based on computer code. For example, Bitcoins are created and traded through a “mining” process in which computer algorithms solve increasingly complex math problems.

Bitmain, Canaan and Ebang, all based in China, make money by selling the high-tech parts and systems that power this mining. Together, They dominate the business.

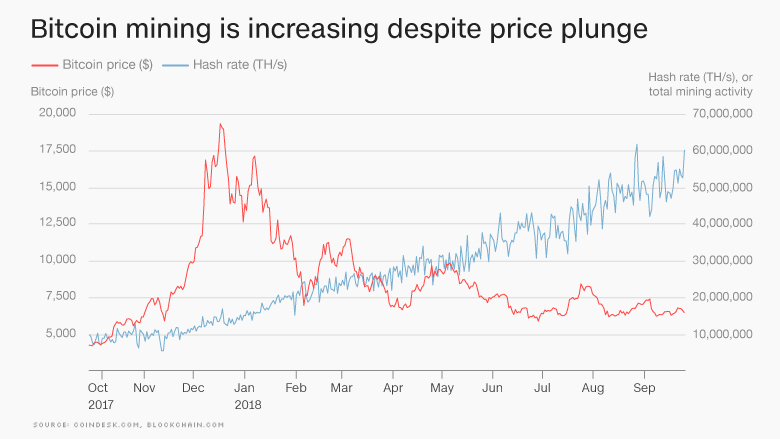

But all three companies operate in a young, unpredictable industry and are planning their IPOs in Hong Kong in brutal market conditions. The price of bitcoin, which peaked at nearly $20,000 in December, has fallen by nearly two-thirds since then. Other cryptocurrencies like Ethereum have also declined.

Bitmain warned potential investors this week, “If the market value of cryptocurrencies suddenly falls … the demand for our mining hardware and cryptocurrency mining services will also fall precipitously.”

On top of that, the Hong Kong stock exchange, where companies plan to list, It entered a bear market this month, falling more than 20% from its previous peak due to concerns about China’s economic slowdown and the trade war with the United States.

The mining technology companies have not said when exactly they plan to go public or how much they plan to raise. Bitmain and Canaan declined interview requests, while Ebang did not respond to a request.

“These companies may be looking to cash out before the market falls even further,” said Benjamin Quinlan, founder of Hong Kong-based financial services consulting firm Quinlan & Associates.

He points out that despite recent setbacks, cryptocurrencies are slowly gaining more acceptance among mainstream investors, and the revenues of the three mining companies are still growing. But the industry faces major challenges.

What matters is how governments regulate digital currencies. Last year, China banned most activities related to Bitcoin. the country is Still considered home to a large number of cryptocurrencies Mining operations, but officials are trying to drive them out.

Cryptocurrency miners require huge amounts of electricity to run their rooms full of computing equipment around the clock. Some public utilities in the United States There are already high tariffs in place, especially for miners.

“Increasing Bitcoin mining costs will reduce demand for mining equipment, which will hinder the performance of these companies,” Quinlan said.

Mining cryptocurrencies is already less profitable.

Bitcoin mining activity has exploded in the past year, driving demand for the technology. But this means that profits from mining are more finely distributed among a larger number of users. This may affect the demand for mining equipment in the future.

Will the mining boom continue?

Bitmain, Canaan and Ebang were profitable in their most recent fiscal year, according to documents revealing their intention to go public.

But staying in the black will be a “big challenge,” said Lily Wang, a Shanghai-based consultant at research firm Kapronasia.

Companies are aware of the risks they face and are trying to adapt. For example, he says they are increasing investment in more advanced chip technology that can be used in areas such as artificial intelligence, cybersecurity and connected devices.

Although the Chinese government has a tough stance on cryptocurrencies in general, it is eager to boost the country’s technological prowess in areas such as computer chips. Chinese companies are still largely dependent on foreign chip technology, especially from the United States.

“whether [the cryptocurrency companies] “Whether they are able to successfully move around remains to be seen,” Wang said.

At the moment, his fortunes are tied to the broader industry.

Quinlan predicted that without greater mainstream adoption “cryptocurrencies will likely decline” in the near future. “It will be extremely difficult for mining equipment manufacturers to survive when the cryptocurrency market as a whole collapses,” he said.

But Bitcoin bulls are still hopeful that the currency could recover as financial exchanges and larger companies begin to take it more seriously.

“As you see people get comfortable with it, it looks like it’s going to grow,” Mike Novogratz, CEO of cryptocurrency investment firm Galaxy Digital, told CNN this week.

CNNMoney (Hong Kong) First Published September 27, 2018: 6:56 AM ET

[ad_2]

Source link

![NZ v AUS [W] 2024/25, New Zealand Women vs Australia Women 2nd ODI, Wellington Match Report, December 21, 2024 NZ v AUS [W] 2024/25, New Zealand Women vs Australia Women 2nd ODI, Wellington Match Report, December 21, 2024](https://i3.wp.com/img1.hscicdn.com/image/upload/f_auto/lsci/db/PICTURES/CMS/393400/393416.6.jpg?w=1200&resize=1200,0&ssl=1)